Fiscal justice

Showing 61 to 90 of 184 results

Latin America: CESR course on budgets and human rights

Registration is open for CESR's course "Sin recursos no hay derechos" at the Latin American "School for Activists", organized by our partners ACIJ, Namati & Red de Empoderamiento Jurídico.

Strategizing with indigenous leaders from Peru and Colombia

Fiscal policies must include indigenousr rights. Watch the reflections of our latest workshop with indigenous leaders from the Amazon and Andes..

From Chile to the world: How the new Constitution can model debating fiscal justice and human rights

The process to draft a new Constitution in the Latin American country is showing how a fruitful public debate around the economy and human rights can happen.

Desigual y Letal: 5 key actions to recover from the pandemic in Latin America & the Caribbean

Our joint report with Amnesty International shows that to address the impact of the pandemic and prepare for others in the future, it is vital to transform fiscal policies in the region.

Why tax justice is critical to the rights of persons with disabilities

As the 2022 Financing for Development Forum gets underway, guest bloggers Polly Meeks and Mirjam Gasser use examples from Switzerland, the UK, and India to illustrate why the rights of persons with disabilities cannot be fully realized without reform of the international tax system.

Key Concepts: Human Rights and the Economy

A series on how to challenge the obscene inequalities in our economies

Fiscal Governance Under the Taliban: an analysis of the first Afghan national budget since the fall of the republic

Even after the Taliban takeover, Afghan researchers & civil society are continuing to scrutinize government: Read this guest blog post by our ally Ibrahim Khan, who looks at the implications of the recently approved budget for human rights in Afghanistan.

Half Measures: Global Digital Tax Proposals Fall Short of Realizing Human Rights

In this working paper, we analyze the human rights impacts of proposals to tax digital multinationals.

A11 and CESR Prompt UN Committee to Scrutinize Austerity Measures in Serbia

A joint report illustrates how the austerity measures introduced by Serbia since 2014 violate the State’s human rights obligations.

Fiscal Policy Needs a Disability Approach: How Do We Make It Possible?

Alberto Vásquez and Karina Huertas propose an inclusive approach to fiscal policy.

Moving Towards a New Generation of Guiding Principles on Business and Human Rights

10 years after the adoption of the Guidelines by the UN, it is urgent to advance towards principles that address the massive scale and human rights impact of corporate tax abuse.

CESR Co-Organizes Strategic Meeting of Indigenous Leaders From Peru and Colombia

At the event, we highlighted how the Principles for Human Rights in Fiscal Policies can aid the claims of indigenous peoples.

CESR's Submission to UN’s Independent Expert on Foreign Debt

We urge Prof. Attiya Waris to investigate the linkages between rising debt, tax systems, governance, and climate action.

CESR Highlights the Importance of Human Rights to Combat Illicit Financial Flows

The Principles for Human Rights in Fiscal Policy were presented at the 4th Conference on the Right to Development & Illicit Financial Flows from Africa.

Webinar Series Addressess Chile’s New Constitution & Fiscal Justice

Co-Organized by CESR and allies, the encounters sparked debates on how to guarantee rights and fiscal justice in Chile's new legal body.

Platforming Workers’ Rights in Global Tax Deals

Will the new “global solutions'' being proposed for taxing multinationals align with workers’ rights? In this new post, we analyze the links between global tax deal proposals and the lives of platform workers.

Principles for Human Rights in Fiscal Policy: a necessary input to discuss the Business and Human Rights agenda

The Principles were highlighted at two important events on the links between businesses and human rights.

CESR Underscores How Human Rights Obligations Can Support Feminist Taxation

CESR Director of Program Kate Donald spoke as part of the "Framing Feminist Taxation" webinar organized by the Global Alliance for Tax Justice and ActionAid.

Tax Reforms and Global Redistribution: Situating the Global South

In this commentary piece for Economic & Political Weekly, our Program Officer, Sakshi Rai, argues for an urgent overhaul of the international financial system, as it continues to undermine workers' rights.

CESR Sends Submission to UN Expert on Foreign Debt

CESR outlined a number of key concerns and proposals to inform her forthcoming report on the international debt architecture and human rights.

Sharing Tools to Track the Human Rights Impact of Fiscal Responses to COVID

On June 2, CESR continued its work with EuroMed Rights’ Economic and Social Rights Working Group, holding a skills-sharing session on evaluating how governments’ fiscal responses to COVID-19 impact people’s human rights.

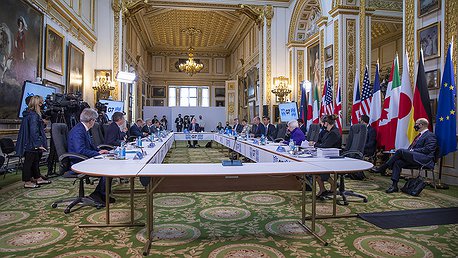

Global Minimum Tax: G7 Agreement Lacks in Legitimacy, Fails to Tackle the Root of the Problem

A truly progressive global tax reform must aim for the fair allocation of taxing rights for Global South countries, challenging the colonial foundations of the international financial system and giving all countries an equal seat at the table.

Join Us at the Fiscal Justice and Human Rights Week

Happening May 17-21, we are co-hosting a whole week of events to launch the Principles for Human Rights in Fiscal Policy.

Freeing Fiscal Space: A Human Rights Imperative in Response to COVID-19

Our Executive Director, Ignacio Saiz, contributed to a new issue of GLOBAL TRENDS. ANALYSIS, published by the Development and Peace Foundation (SEF).

What Fiscal Reforms Is Latin America Clamoring for, and How Can We Make Them a Reality?

The current crisis in Colombia - where large-scale protests have been sparked by a proposed fiscal reform package - clearly shows the need for revitalizing the connection between fiscal policy and rights in the Latin American region and beyond. CESR is working with partners to do just this: opening tax debates to those whose rights are most affected by them.

Organizations in Latin America Call on the Colombian Government to Put an End to Violence Against Protestors

CESR supports the call of organizations from throughout the region demanding that Colombian authorities guarantee citizens’ rights to mobilize peacefully and take part in fiscal debates.

Fostering new approaches to monitor COVID recovery in MENA

We shared toolkits and methods for a rights-based monitoring of COVID-19 recovery with the Oxfam FAIR-EiU Knowledge Hub forum.

%2014.32.27.png.458x258_q85_box-0%2C64%2C2142%2C1271_crop_detail.png)

Rights Not Debts

CESR contributed to Progressive International's Debt Justice Blueprint, a series of essays that tackle the different dimensions of debt.

Transform Fiscal Policy Using Legal Advocacy - Lab Series

Between February 23rd and March 25th, CESR and allies will be hosting a series of laboratories on how to use litigation and legal advocacy to transform how resources are distributed.

CESR participates in the Global South Women's Forum on Disrupting Macroeconomics

From 14-18 December 2020, CESR participated in the Global South Women's Forum on Disrupting Macroeconomics, organized by International Women's Rights Action Watch Asia Pacific (IWRAW-AP).