Fiscal justice

Showing 91 to 120 of 184 results

Confronting COVID: How Civil Society is Responding Across Countries | Mexico

Máximo Ernesto Jaramillo-Molina of Fundar, Center of Analysis and Research explains the policy responses needed to respond to the pandemic in Mexico.

Fiscal justice and human rights: strengthening collective counterpower for a transformative recovery in Latin America and the Caribbean

Latin America will be the region most affected by the COVID-19 pandemic, suffering its worst crisis in the last hundred years ,and the impacts will affect a region that already suffers severe inequality.

Confronting COVID: How Civil Society is Responding Across Countries | Serbia

Danilo Ćurčić discusses how in a country where nearly one quarter of the population is at risk of poverty, the pandemic has had devastating consequences on already marginalized communities.

Dialogue on Human Rights and Fiscal Policy in the constituent process in Chile

The October 14th dialogue discussed the importance of addressing fiscal discussions in Chile’s constitutional reform process from a human rights perspective.

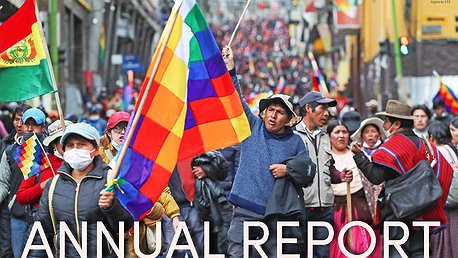

2019 Annual Report

CESR's annual report for 2019 surveys the impact of our work in a year when millions around the world took to the streets. It shares some of the progress we made—in countries around the world, in international human rights and development spaces, and in the broader field of social justice activism which we serve.

Will the IMF align with human rights and fiscal justice after COVID-19? Lessons from Latin America and the Caribbean

CESR co-organized an event at the Civil Society Policy Forum of the 2020 World Bank Group and IMF Annual Meetings exploring this question.

International Journal of Human Rights: Special Issue on human rights and economic policy reform

Volume 24, Issue 9 of the International Journal of Human Rights is a special issue, co-edited by Aoife Nolan and Juan Pablo Bohoslavsky. It brings together experts working on human rights and economic policy from a range of disciplinary perspectives, including economics, law, and development studies.

IMF annuals side-event: The Role of IFIs in a World of Intersecting Conflicts and Crises in the Middle East and North Africa

On Friday, October 5, 2020 CESR participated in a session that assessed IFI's policies in contexts of crises and conflicts, mainly in the MENA Region—examining the existing policies and their impact on inequality.

IMF annuals side-event: Changing the rules for a just recovery

On September 30th, CESR's Executive Director, Ignacio Saiz, moderated a panel on "Changing the rules for a just recovery: aligning IMF's work with human rights and fiscal justice in Latin America and he Caribbean".

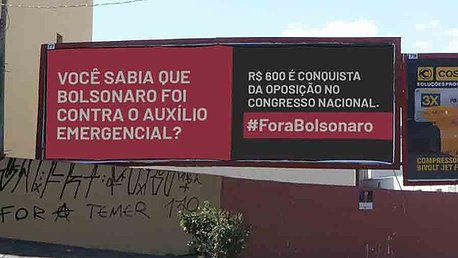

Confronting COVID: How Civil Society is Responding Across Countries | Brazil

The Fight for Human Rights in the Context of COVID-19: a tough ride for Brazilian civil society organizations. Guest blog by Livi Gerbase, policy advisor at the Instituto de Estudos Socioeconômicos (INESC).

IMF annuals side-event: The Role of IFIs in a World of Intersecting Conflicts and Crises in the MENA Region

Taking place 5 October 2020, this session will assess IFI's policies in contexts of crises and conflicts, mainly in the MENA Region, by examining the existing policies and their impact on inequality.

A Marathon, Not a Sprint: Peru Needs Fiscal Reforms to Quell High COVID-19 Death Rate

Sergio Chaparro and Laura Adriaensens on Inter Press Service discuss how Peru has been one of the Latin American countries with the lowest investment in social policies, leading to deep disparities in the realization of social rights.

CESR and Partners Hold Dialogues on Just Economic Recovery from COVID

The Initiative for Human Rights Principles in Fiscal Policy held a series of virtual dialogues with partners aimed at sharing tools and exploring opportunities to advocate for a just economic recovery from the COVID-19 crisis.

Forging Tools for Fiscal Justice in the Andean Region

Since 2016, CESR has worked with civil society partners in Peru and Colombia to build greater consensus on how public resources can be more equitably generated and distributed, in line with human rights obligations.

Manuals & Guides, Publications

An Advocacy Toolkit for Fiscal Justice and Human Rights

The Advocacy Toolkit assists civil society organizations who want to leverage human rights standards and strategies in their pursuit of accountability for injustices rooted in economic policy.

Confronting COVID: How Civil Society is Responding Across Countries | Argentina

Julieta Izcurdia of ACIJ argues for centering the rights of groups that suffer the most under COVID and for a fairer tax system in the long term.

Peru: Financing a Just Recovery to Achieve the Sustainable Development Goals

Behind a facade of economic success, Peru hides deep multidimensional inequalities which jeopardize achievement of the 2030 Agenda.

CESR's Kate Donald Discusses Tax Biases Against Women and the Global South

"Taxation for Redistributive Justice: Solutions for Women, People and Planet" discussed tax policy biases that negatively impact women and other disadvantaged groups, as well as countries of the Global South.

Human Rights Law Must Help Shape Government Responses to COVID-19

Allison Corkery's blog post at Equal Times emphasizes how upholding socioeconomic rights in a pandemic remains an obligation—and the law.

A Comprehensive Response to COVID-19 Demands Redistributive Fiscal Policies

CESR and partners at the Initiative for Human Rights in Fiscal Policy in Latin America call on States to undertake broad fiscal redistribution in order to avoid dire human rights consequences of the COVID-19 crisis.

CESR's Sergio Chaparro Discusses COVID-19 Debt Relief on International News Network France 24

Chaparro said that while the G20's agreement to suspend debt payments from pooer countries was welcome, it did not go far enough.

Reviving Beijing's Neglected Macroeconomic Agenda: Tax Justice for Women’s Rights

On March 13, CESR co-sponsors a CSW parallel event on tax justice for women's rights, organized by the Global Alliance for Tax Justice’s tax and gender working group.

Spain: From Laggard to Leader on Social Rights?

Devastating findings of UN poverty expert’s recent visit to Spain put the new government’s commitments on social rights to the test.

ESCR-Net Covers CESR's Dismantling the Dogmas

ESCR-Net covered CESR's Dismantling the Dogmas of Austerity and Fiscal Injustice in Latin America.

Fiscal Policy, Inequality and Human Rights in Peru

Peru's success story in terms of growth and poverty reduction requires a more nuanced evaluation, given persistent inequalities and the government's failure to guarantee social rights and ensure sustainable growth through sound fiscal practices. This short video offers two compelling examples of unjustified rights deprivations caused by the country's unfair fiscal and budgetary policies: the setbacks in bilingual intercultural education policy and the lack of adequate funding for cancer policies.

Dismantling the Dogmas: Tools for Tackling Austerity in Latin America

New briefing confronts head-on dogmas that are deployed against progressive structural fiscal reforms in Latin America.

Global Protests Demand Human Rights Actors Tackle Economic Injustice

Ignacio Saiz' submission to OpenGlobalRightsArticulo en español

Resources Restricting Rights: Fiscal Policy, Inequality and Social Rights in Peru

Funding gaps for education and healthcare in Peru create significant obstacles to the guarantee of human rights and economic equality.

Unequal and Unjust: the Human Rights Costs of Tax and Budget Decisions in Peru

A new report from CESR finds that Peru’s unjust tax and budget policies threaten quality education for the country’s Indigenous children and restrict access to prompt cancer treatment for some underserved patients.

Assessing Austerity's Impacts on Human Lives

CESR's Sergio Chaparro recently lectured about assessing the human impacts of economic austerity policies at The American University in Cairo.