Earlier this month, a worldwide network of 30 civil society organizations—including Oxfam, Amnesty International, Save the Children, and Action Aid—led by CESR, presented a collective submission to the Ad Hoc Committee tasked with drafting the Terms of Reference for the United Nations Framework Convention on International Tax Cooperation (UNTC). Its objective is to ensure that global tax cooperation frameworks place human rights at their center. Here, we look at the progress made so far and the next steps in the unprecedented process of creating a global treaty on tax through the UN.

Written by Matthew Forgette, CESR’s Post-graduate Fellow and Pulkit Palak International Law & Human Rights Fellow

Last December, the United Nations General Assembly, led by the Africa Group, passed a landmark resolution to establish a global tax convention. Member states expressed their conviction that a truly inclusive transformation of international tax rules must take place under the auspices of the United Nations. Still, the decision was far from unanimous. A powerful bloc led by the United States, the United Kingdom, and other Global North countries voted against the resolution. In the waning moments before the vote, the United Kingdom introduced an amendment to rid the proposal of any mention of the word “convention,” an attempt to impede the legally binding nature of the future output endorsed by the UN resolution.

The process and forum for international tax reform are critical because the gross impact of global tax avoidance is staggering. One recent study found that countries are losing $480 billion dollars a year due to tax abuse. The brunt of that harm is falling on lower-income countries, whose tax losses equate to roughly 49% of their public health budgets (compared to just 9% in higher-income countries). Another report indicated that more than $1 trillion dollars in profits were shifted to tax havens in 2022.

As CESR has noted in the past on this blog, a UN Tax Convention represents a historic step towards inclusive and effective international tax reform, emphasising human rights and justice for Global South countries that have been disproportionately harmed under the current global tax regime. Nevertheless, as noted above, states and multinational enterprises that benefit from the current international tax structure are unlikely to submit to these changes without a fight. Certain stakeholders may strive to water-down the terms of the UN Tax Convention to mirror the Inclusive Framework.

Thus, it is crucial to closely follow the UN Tax Convention as it plays out over the coming months, paying particular attention to key stakeholders, procedural and decision-making elements, and the terms of reference in the convention. This blog offers an update on the UN Tax Convention process, summarizing where it is at the moment, what the next steps will look like, and providing insight into CESR’s own role in the proceedings.

The Current UNTC Process

Recent updates to the UN Tax Convention process came on February 20-22, when the UN General Assembly’s Ad-Hoc Intergovernmental Committee began preliminary negotiations on terms of reference for the Framework Convention on International Tax Cooperation (the new official name for UN Tax Convention). Essentially, these discussions were process-based. They sought to agree on decision-making procedures, elect a bureau, establish the working modalities of the Committee, and begin analyzing what specific problems should be addressed by the Convention.

One of the critical outputs of these meetings was the creation of a bureau, which will analyze proposals for the terms of reference for the convention before bringing them to the attention of the Committee for further negotiations. The bureau consists of 20 member-states from 4 regions:

-

Africa: Ghana, Kenya, Morocco, and Egypt

-

Asia: Singapore, India, Republic of Korea, and China

-

Latin America and the Caribbean (whose members will rotate in pairs for alternating Committee sessions): Colombia/Bolivia, Mexico/Chile, Bahamas/Jamaica, and Brazil/Peru

-

Western Europe: Italy, Germany, Spain, and Norway

-

Central and Eastern Europe: Russia, Belarus, Estonia, and Poland

The diversity of regions and member-states was an early welcome sign of a participatory process, as was the election of Egypt as the chair of the Ad-Hoc committee, given the Africa Group’s leadership role in the adoption of a UN Tax Convention.

Another encouraging sign that emerged from the February discussions was the agreed-upon approach to decision-making procedures. Given the previous resistance to the Convention mentioned earlier, there had been some trepidation that powerful stakeholders like the United States, EU countries, and Japan would push for consensus in decision-making, essentially granting veto power. Although attempted initially, this did not materialize, and the Committee was able to agree on a simple majority vote approach due to the much-appreciated active engagement of all countries, even blockers (US, EU, Japan, etc).

Finally, perhaps the most important aspect of these discussions was its analysis of how the Convention should actually address global tax reform. Several Global states placed particular emphasis on the intersection between tax policy and climate change, as well as the human rights obligation to mobilize all available resources to realize economic and social rights. With this in mind, the upcoming steps in the UN Tax Convention process will be crucial in determining the actual changes that will result from this re-writing of the global tax rules. The Ad-Hoc Committee issued a call for inputs from member states and other stakeholders on the question “What are some specific problems that could be addressed by a UN framework convention on international tax cooperation?”. CESR, supported by multiple signatories, used the opportunity to submit its input on the imminent need to include human rights norms within the terms of reference, and also coordinated other inputs that sought to include climate financing and gender mainstreaming within the Framework Convention’s scope.

CESR’s Submission on the Framework Convention on International Tax Cooperation (FCITC)

CESR naturally welcomed the opportunity to contribute to the discussion surrounding the Framework Convention’s terms of reference, and our primary concern was to argue for the undeniable importance of incorporating human rights norms within these terms of reference. Our submission highlighted the importance of human rights as an integral aspect of the international legal framework, and noted that member states are bound by obligations set out in their verified human rights treaties, and these rights offer a benchmark by which to assess international financial architecture in general and international tax systems in particular.

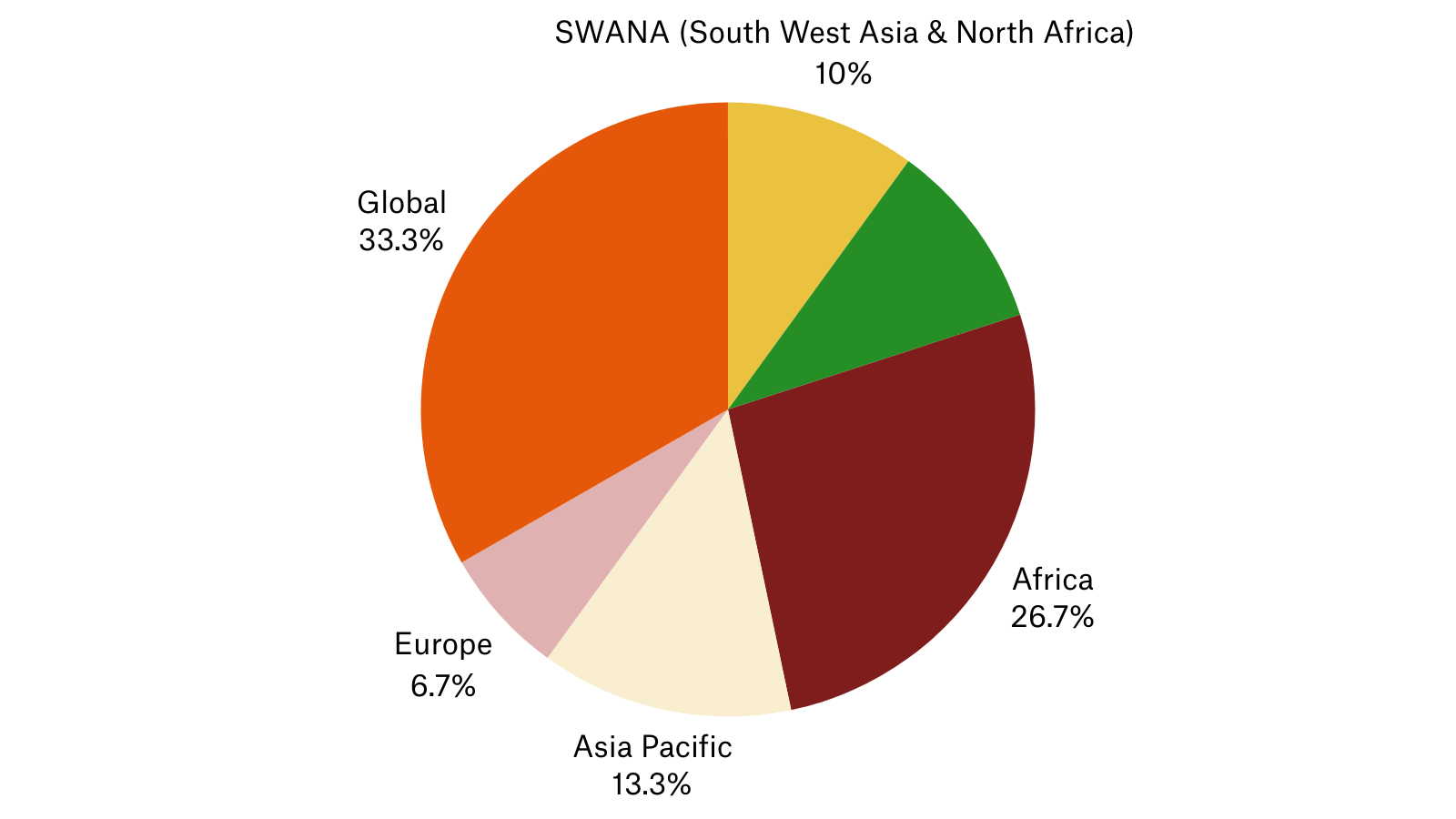

Regions of signatory organizations

See the full list of signatories here

The submission also called attention to several human rights obligations that must serve as guiding and interpretive principles for the Framework Convention. Some of the human rights principles were focused on state responsibility, such as: states’ duty to mobilize maximum available resources towards realizing human rights, states’ duty to cooperate internationally, states’ extraterritorial obligation to realize human rights beyond their borders. Other human rights principles we argue must be advocated for center on creating a fair and transparent international tax system, such as: equality and non-discrimination, transparency, and inclusiveness, participation, and the right to self-determination. Crucially, our input also emphasizes that the Framework Convention should specify resourcing and realizing human rights as one of its key goals.

Of course, the work to make the UN Tax Convention a truly transformative reform of global tax policy is far from over. The Ad-Hoc Committee will meet again from April 26th-May 8th to begin negotiation on the terms of reference, basis the specific problems highlighted by the inputs and from July 29th to August 16th to incorporate the terms of reference. CESR will continue to provide updates and analysis on these vital proceedings, hoping to encourage the creation of a participatory and transparent global mechanism for tax policy.