Ahead of the last round of consultations being held by the UN’s Secretary-General before the finalization of his report on a Tax Convention, we took a detailed look at the inputs sent by Member States and relevant stakeholders. The analysis showed how strong the opposition to a global convention is given the Global North’s interests to maintain course, and how urgent it is for civil society to get involved in the process and fight for a treaty that advances real tax justice.

By: Pulkit Palak, International Law & Human Rights Fellow at CESR

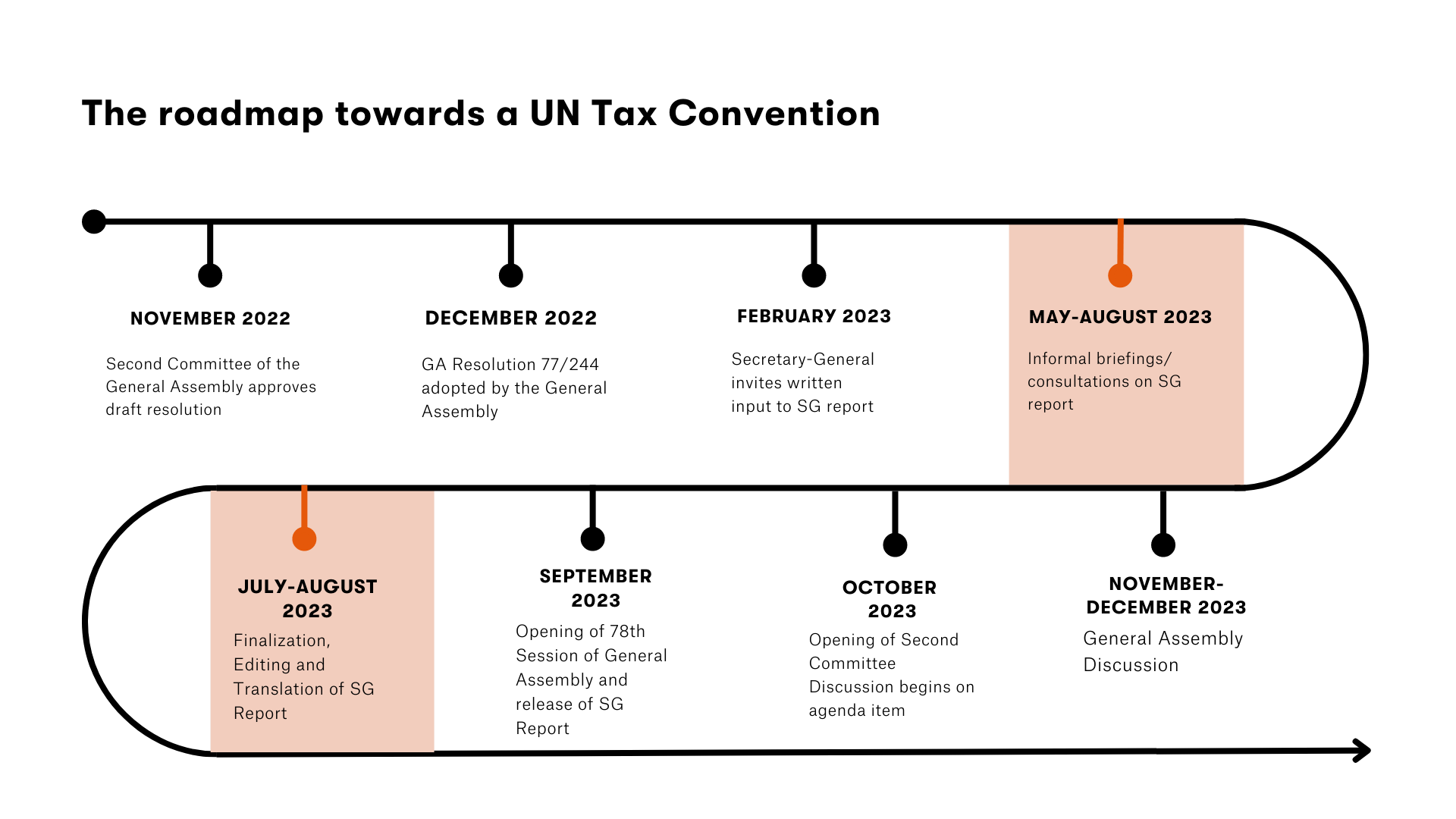

As a result of groundbreaking efforts by African Countries the United Nations General Assembly adopted last December its resolution on the promotion of inclusive and effective international tax cooperation . The resolution laid down the ground for intergovernmental discussions at the organization on ways to strengthen the inclusiveness and effectiveness of international tax cooperation, including the possibility of developing an unprecedented instrument that is developed and agreed upon through a United Nations intergovernmental process.

This was not the first effort by the developing nations to draw the United Nations’s attention to the need for a global inclusive tax cooperation architecture. Although these demands have been supported by various panels and Civil Society Organisations in the past, they have met resistance from the Global North, seeking to maintain their upper hand in the international tax rule setting arena. Once it was apparent that the adoption of the resolution was inevitable, similar attempts were made by the United States to water down the resolution, but remained unsuccessful this time despite having the support of over 50 countries. Holdouts from a large section of member states for a resolution merely discussing the possibility of an international tax cooperation framework or instrument forces us to ponder the irony of their claims of an existing structure that is truly inclusive.

The Secretary General’s call for inputs prior to the drafting of his report received 92 submissions in total, which comprised 28 responses from Member States. They include consolidated group submissions from the European Union (on behalf of its 28 European Union Member States) and the African Group (on behalf of 54 African Union Member States). While Member States such as Armenia, Belarus, Costa Rica, Dominican Republic and Ukraine provided inputs solely on the current international tax cooperation practices adhered to by each of them, most member states submitting inputs utilized the opportunity to take a definitive stand regarding the existing tax cooperation regime and potential next steps. Although, the Secretary General is also conducting informal briefings with the stakeholders, the submission of written inputs provided the Member States with a platform to take a definitive stand publically, and provides an insight into what their positions will be as the at all further stages including the next General Assembly Session discussions when the Secretary General's report shall be considered for further action. This peek into the arguments and strength in numbers presented by both sides is not only going to be important for the tax justice movement to plan their next steps but is also likely to influence the opinions of other member states who have chosen to remain silent in this debate till most cards are on the table.

The European Union came swiftly to the defense of the existing efforts of the existing international fora such as the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) and the Global Forum on Transparency and Exchange of Information. Their contribution urges the United Nations to support ongoing negotiating processes on the OECD Inclusive Forum in order to avoid duplication of international efforts and risk of inconsistent outcomes. They claim thatthe existing multilateral fora, especially the OECD Inclusive Framework are inclusive in nature and allow developing countries to effectively participate in decision-making. France, Germany, Italy, Spain and Switzerland submitted their own inputs in addition to the consolidated response echoing the sentiments, further arguing the effectiveness of existing structures. These responses politely acknowledge the “capacity building” and unique position of the United Nations which should be utilized in terms of increasing United Nation’s collaboration with existing structures, citing the instance of the Platform for Collaboration on Tax (PCT), a joint initiative of the International Monetary Fund (IMF), the Organization for Economic Co-operation and Development (OECD), the United Nations and the World Bank Group (WBG) to strengthen collaboration on domestic resource mobilization. Interestingly, Japan goes a step further to insist that the Inclusive Framework is a more inclusive forum than the United Nations because the Inclusive Framework includes non-state jurisdictions and bases its decision on consensus amongst all members instead of simple majority rule. All in all, 17 out of 28 submissions from member states were affirming their allegiance to the status quo including inputs from the Global North included submissions from Australia, Canada, New Zealand, Singapore, United Kingdom and United States. It is also intriguing to consider that despite China’s previous calls along with the G77 for establishing an intergovernmental subsidiary body under the auspices of the United Nations, its input remains silent on the subject and simply suggests increased collaboration and dialogue of United nations with regional tax organizations.

The numerical strength of inputs in favor of status quo are balanced by 6 progressive inputs which includes the African Group of 54 Member states. The African Group highlighted the debt sustainability challenges being faced by African Nations and called for a report that underscores the importance of financing sustainable development agenda. The group requests that the report should address illicit financial flows as a development challenge, given the disproportionate impact on the developing countries. The response brings out the criticisms of the Inclusive Framework, namely the anticipated failure of the framework to generate any additional resources for the developing countries and its non-universal nature and recommends a United Nations Tax Convention and a global inclusive forum for international tax cooperation. Nigeria and Morocco provided additional inputs arguing that existence of other forums should not prevent the United Nations from taking steps to further universalism. Russia and India have made submissions in support of the establishment of an intergovernmental Member-State led body while outlining potential focus areas and scope of work for such a forum.

Chart by Pulkit Palak

The positions of international organizations

Eight responses received from the Committee of Experts on International Cooperation in Tax Matters reflected equally divided personal opinions on the need for a universal United Nations led international tax cooperation framework. Amongst the 7 inputs received from various United Nations Organization/Entities, the United Nations Conference on Trade and Development (UNCTAD) provides a nuanced evaluation of the current international tax regime, highlighting the problems relating inclusivity in the fora and technical difficulties of the Inclusive Framework’s Two Pillar Plan. The United Nations Environment Program draws the conversation towards environment taxation and resource mobilization to achieve a just transition. UN Women stresses the need to mainstream gender considerations in fiscal and tax debates and urges that the same should be kept in mind should an international convention be adopted. Here it must be noted that UN Women’s submission was the only input submitted by Member States or UN Organizations that go beyond passing references of Sustainable Development Goals (SDG’s) to call for alignment of the international tax system to human rights norms.

Half of the “other international organizations'' that submitted their inputs to the Secretary-General belong to the African region, with the African Union, West African Tax Administration Forum and African Tax Administrative Forum supporting establishment of an UN intergovernmental body complementing existing efforts of tax cooperation. Other international organization coalitions from the Global South that came out in support of an intergovernmental body include G-24 and South Centre, an intergovernmental organization of developing countries, which has 55 Member States spanning Africa, Asia, and Latin America. OECD is the only international organization in this category of submissions representing its own interests and that of the Global North, but it chooses to outline its existing efforts, staying silent on any recommendations to the Secretary-General.

It comes as no surprise that a majority of the inputs received from Business and other relevant stakeholders (10 in total) support the status quo, forwarding arguments to avoid duplication of forum, cost-effectiveness and diversion of resources from SDG’s. These submissions recommend a similar diluted role of the United Nations in furthering capacity building of developing nations and partnering with regional organizations. The submission made by the International Bar Association stands out in this category as it supports the establishment of a global tribunal by the United States.

It is in fact the overwhelming response received from the Civil Society and Academia that is most commendable in their efforts to provide progressive analyses of the existing tax cooperation regime and succinct recommendations for consideration by the Secretary General in his report. In addition to technical inputs from academics, civil society coalitions such as Civil Society Financing for Development Mechanism, Digital Cooperation Organization, Public Services International, Tax Justice International representing the interests of civil society organizations, private sector, trade unions unequivocally support the call for a United Nations Tax Convention providing and inclusive fora for international tax governance. The Civil Society Financing for Development Mechanism submission is signed by 90+ civil society organizations including Oxfam, European Network on Debt and Development (both of whom have submitted additional inputs as well) and other civil society networks. This submission alone has roughly the same number of signatories as the total number of inputs received.

The arguments for and against a Tax Convention

The two factions argue for and against overhauling the international tax cooperation regime using the same set of arguments, for instance while the status quo lobby claims an UN administered tax body would lead to duplication of forum, South Center submits that there already exists a plethora of international tax fora with overlapping mandates. Arguments for global tax justice posit that redistribution of taxing rights through inclusive forum and debates will allow developing countries to tap illicit financial flows & lost tax revenue and mobilize resources towards sustainable development, the opponents argue that participating in yet another forum will require significant resources that could have been diverted towards meeting SDG’s. Naturally, there is also a stark difference in technical problem areas suggested to be looked into by the two camps as well. While the supporters of the existing regime offer half-way measures that may be undertaken by the United Nations, it suggests that the Secretary-General’s report should broaden its scope and look beyond corporate income tax and shift the focus away from multinational enterprises. Calls for reform also acknowledge UN’s potential role in capacity building and involvement with regional bodies, but they do so on top of demanding an intergovernmental body that may look into focused issues such as the transfer pricing system, taxation of services, remote workers, high net worth individuals, collection and exchange of tax data.

Irrespective of submissions made to the contrary by Global North institutions, it remains clear that the current international tax regime driven by the OECD lacks statutory basis, universality and inclusivity in agenda setting & decision-making mechanisms, which has been disproportionately detrimental to the developing nations. Given its position, the United Nations possesses the unique ability to bridge this gap by creating a truly participatory and transparent global forum that promotes fairness towards the developing nations, increasing state accountability and strengthening the role of human rights and development in global tax debates. The General Assembly resolution was a historic win but as stakeholder consultations continue prior to the presentation of Secretary-General’s report it is essential that the tax justice movement joins forces with other Civil Society Organizations to counter the efforts to perpetuate the OECD led status quo.

.png)