Fiscal justice

Showing 121 to 150 of 184 results

Lessons from Ecuador: Challenging Austerity and Human Rights Erosion at the IMF

CESR will be at the World Bank/IMF Annual Meetings this week, challenging the IMF’s global role in driving austerity measures that result in the steady erosion of human rights in countries such as Ecuador.

Austerity and Human Rights in Ecuador: An Urgent Appeal to the IMF

Fiscal policy cannot be imposed while ignoring people’s rights, as the Indigenous peoples’ protest movement in Ecuador has shown.

Fiscal Policy and the Rights of Indigenous and Afro-descendant Peoples

Video from workshop in Bogotá bringing together Indigenous and Afro-descendant leaders from Peru and Colombia to discuss the links between unjust fiscal policies, extractive industries, and the rights and wellbeing of these communities..

Speaking Truth to Power: Growing the Movement to Fight Inequality

Stark power imbalances are fueling extreme global inequality and cross-movement alliances within civil society are needed to combat the problem.

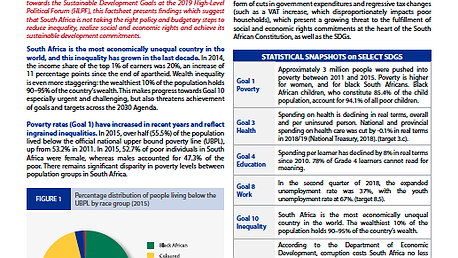

South Africa: Is Resource Mobilization Reducing Inequality?

As South Africa presents its review at the High-Level Political Forum (HLPF) in New York, a rights-based snapshot of obstacles and opportunities is put forward by CESR, the Institute for Economic Justice and Section 27.

Spotlight on Inequalities at High-Level SDG Forum 2019

The Spotlight on Sustainable Development Report 2019 asserts that successful implementation of the SDGs requires more holistic and more sweeping shifts in how and where power is vested, including through institutional, legal and political commitments to realizing human rights.

Linking Fiscal and Environmental Justice Agendas in the Andean Region

Environmental, socioeconomic and fiscal injustices in the Andean Region mutually reinforce each other, disproportionally affecting the rights and wellbeing of Indigenous peoples and Afro-descendant communities.

Financial Restrictions and Human Rights: the Case of Colombia

CESR's Sergio Chaparro recently published a chapter on "Financial restrictions and human rights: the case of Colombia" in the latest volume of the Journal of the Ministerio Público de la Defensa de la Ciudad de Buenos Aires.

The State of Tax in Latin America: Massive Evasion and Avoidance Block Human Rights and Development

States are obligated to mobilize their maximum available resources to progressively advance rights and reduce disparities between the wealthy and the most disadvantaged.

Commission on the Status of Women 2019: Progressive Taxation Indispensable for Gender Equality

CESR participated actively in the 2019 Commission on the Status of Women at the United Nations HQ in New York. The priority theme of this year’s Commission was "social protection systems, access to public services and sustainable infrastructure for gender equality."

Highlighting Austerity, Gender and Tax Issues at IMF, World Bank Spring Meetings 2019

In April 2019, Kate Donald (the Director of CESR’s Economic and Social Policy program) attended the IMF/World Bank Spring Meetings in Washington, DC. While there, she shared CESR’s research in several meetings with IMF officials, including work on the relationship between tax policy and gender equality, along with civil society partners and allies.

New Human Rights and Fiscal Justice Initiative Calls for Global Corporate Tax Reforms

The Initiative for Human Rights Principles and Guidelines in Fiscal Policy in Latin America is demanding radical changes to the rules of global taxation in order to stop tax avoidance and the race to the bottom in corporate tax rates.

Legacies of apartheid: South African austerity perpetuates the inequalities of decades past

The South African government’s adoption of austerity measures now perpetuates many of the same inequalities that apartheid upheld many years ago.

Beyond Boundaries: Allying human rights with other struggles for social and economic justice

The August 2018 international convening identified strategies for more dynamic engagement between economic and social rights actors and others working for similar goals.

CESR allies with ICRICT to re-envision international corporate tax rules

ICRICT, an independent, nonpartisan group of global tax experts, seeks to reform the international corporate taxation system by fostering a broad-based, inclusive discussion of the rules governing how multinationals are taxed.

Beyond Boundaries Convening Summary Report

The summary report is available in pdf format here

%20_2.png.458x258_q85_box-0%2C2%2C703%2C397_crop_detail.png)

South Africa urged to end austerity measures amid "unacceptably high levels of inequality"

Civil society inputs documenting rights deprivations in health, education, tax policies were crucial to CESCR recommendation.

Beyond Boundaries: allying human rights with other struggles for economic and social justice

Groundbreaking gathering of diverse social justice movements affirmed the need to maintain a focus on long-term systemic change and a commitment to reciprocity and mutual learning.

%20_1.png.458x258_q85_box-0%2C2%2C703%2C397_crop_detail.png)

UN Committee interrogates harmful austerity policies in South Africa after receiving compelling evidence from civil society groups

PRESS RELEASE: The UN Committee on Economic, Social and Cultural Rights grilled the South African government delegation on healthcare and education cuts, regressive tax changes and rampant corruption at country’s first review.

%20.png.458x258_q85_box-0%2C2%2C703%2C397_crop_detail.png)

Civil society organizations urge South Africa to end austerity measures and combat inequality

As South Africa presents its first human rights compliance report to the United Nations Committee on Economic, Social and Cultural Rights, CSOs call for a human rights-based approach to fiscal and economic policy, steps to tackle corruption and increased funding for healthcare and education.

Rights and resources: fostering governments' compliance with human rights

Governments can realize maximum available resources by referencing current distributional debates and establishing hard law solutions via the international human rights ecosystem.

Tax abuse leads to human rights abuse

Policy-makers have played Jenga with the broken international corporate tax system for some time. It’s time to build a new foundation for effective taxation of multinationals.

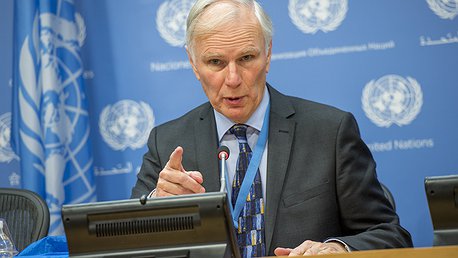

UN poverty expert urges the U.S. to “get real about taxes”

U.N. poverty expert Philip Alston's report on U.S. poverty reflects CESR concerns about effects of tax cuts on human rights and inequality.

Rising inequality is a wake-up call for human rights

Media: Ignacio Saiz writes in Open Global Rights that the challenges economic inequality poses for human rights are not the death knell for the movement but a wake-up call for a more holistic approach.

Latin American countries must reform their fiscal policies to guarantee human rights

Unjust fiscal policy measures adopted by some Latin American countries strip basic social protections from populations, creating rights deficits and sowing unrest.

Fiscal Policies and the Safeguarding of Economic, Social and Cultural Rights in Latin America: Argentina, Brazil, Colombia and Peru

Fiscal Policies and the Safeguarding of Economic, Social and Cultural Rights in Latin America

Economic inequality and human rights: towards a more nuanced assessment

The challenges facing human rights are not the death knell for the movement, but a wake up call for a more holistic approach.

United Nations urges Spain to end detrimental austerity measures

Press release: UN Committee on Economic, Social and Cultural Rights calls for a more redistributive fiscal system that addresses rising economic and social inequalities